Lien Law & Compliance Basics

Before discussing "how" to invoice, we must address "why" the format matters legally. In the construction sector, your invoice is not just a payment request; it is the primary evidence in a Mechanic's Lien claim.

The Entity Rule: 2026 regulations increasingly require that invoices reflect the legal entity of the contractor exactly as it appears on the contractor's license. Discrepancies between the "Billed By" name and the "Licensed Entity" name can void your payment rights.

State-by-State Mechanic's Lien Requirements

Lien laws vary significantly by state. Here are the key deadlines for major construction markets:

| State | Preliminary Notice | Lien Filing Deadline | Key Requirement |

|---|---|---|---|

| California | 20 days | 90 days after completion | Preliminary 20-Day Notice required |

| Texas | By 15th of 3rd month (subs) | By 15th of 4th month | Notice to Owner required for subs |

| Florida | 45 days (Notice to Owner) | 90 days after completion | Notice to Owner mandatory |

| New York | Not required | 8 months after completion | Serve lien copy within 30 days of filing |

| Illinois | None for direct contractors | 4 months after completion | Subs must serve Notice within 90 days |

| Ohio | 21 days (Notice of Furnishing) | 75 days after completion | Affidavit required with lien |

Note: This is a general overview. Consult a local construction attorney for specific requirements in your jurisdiction.

Why Standard Invoices Fail Contractors

Using a generic "service invoice" (like those for graphic designers or consultants) is dangerous for tradespeople. Construction billing requires specific data points to track Project Continuity.

- Risk of Audit: Failure to separate capital improvements (often exempt) from repair labor (taxable) can trigger sales tax audits.

- Scope Creep Liability: Without explicit "Change Order" line items, extra work is often legally interpreted as "included in the original contract."

- Retainage Gaps: Standard invoices do not have fields for "Stored Materials" or "Retainage Held," causing accounting errors.

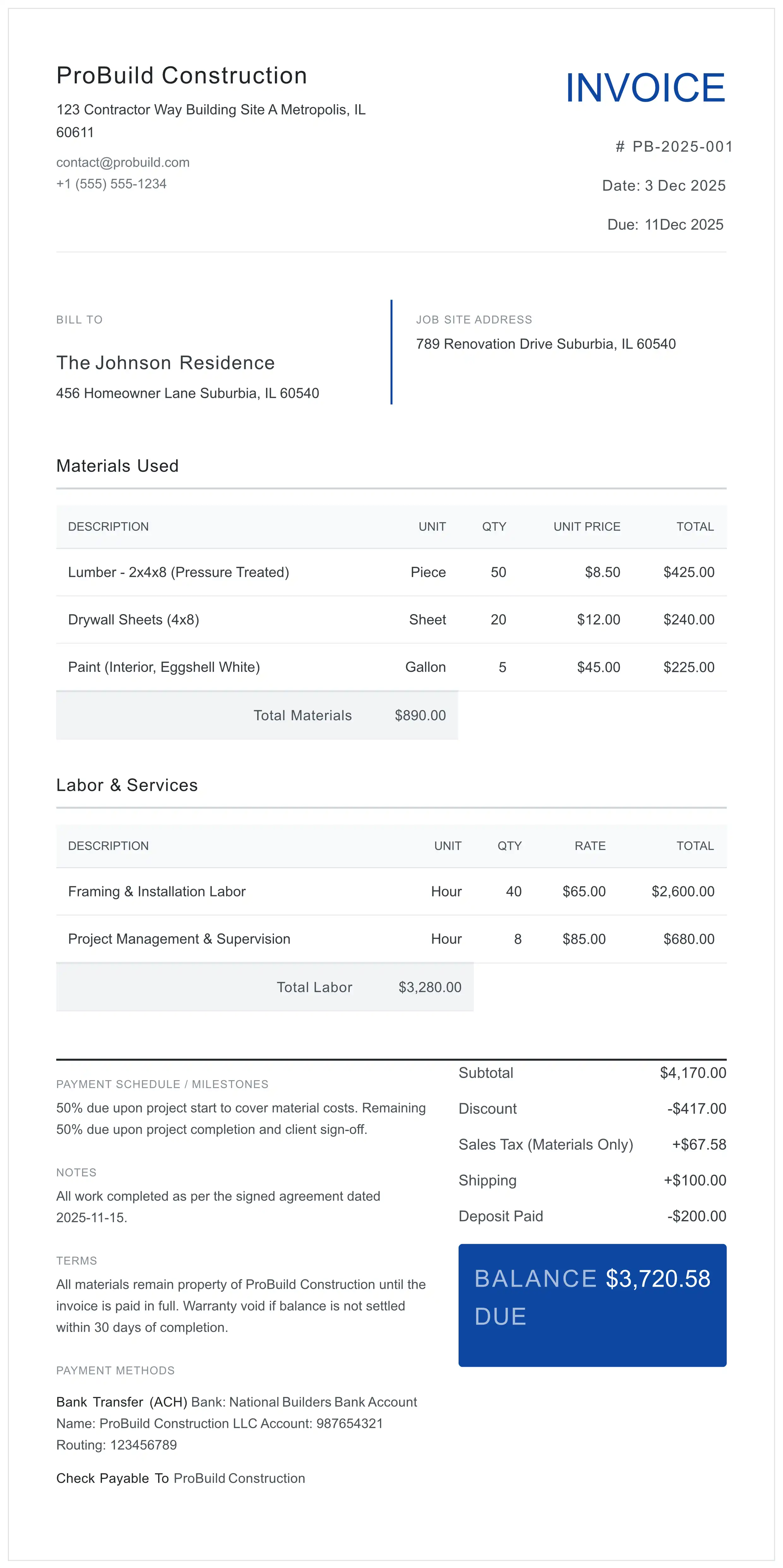

Anatomy of a Compliant Invoice

To pass a rigorous payment application process (especially with General Contractors or Commercial Clients), your document must adhere to the following structure.

✅ Mandatory Fields for Compliance

- Legal Job Site Address: Must match the property deed/contract, even if the client's billing address is different.

- Contractor License Number: Required in most states to compel payment.

- Period of Performance: The specific dates work was performed (crucial for "Statute of Limitations" on liens).

- Detailed Scope Breakdown: "For bathroom renovation" is insufficient. Breakdown by "Demolition," "Rough-in," "Finish."

- Payment Application #: Sequential numbering tied to the master contract (e.g., Pay App #003).

Tax Rules: Labor vs Materials

According to major tax authorities (including the IRS guidelines and state equivalents), the taxability of a project often hinges on the separation of costs.

Industry Best Practice: Always segregate items.

| Cost Category | Tax Treatment (General Standard) | Invoicing Protocol |

|---|---|---|

| Tangible Personal Property (Materials) | Generally Taxable | List cost + applicable sales tax. |

| Capital Improvement Labor | Often Tax Exempt (New Construction/Value Add) | List separately. Do NOT apply tax if exempt cert is on file. |

| Repair/Maintenance Labor | Often Taxable | Check local jurisdiction. Often taxed like materials. |

The 2026 Digital Standard (E-Invoicing)

Handwritten carbon-copy receipts are increasingly outdated in professional construction management. In 2026, Digital Traceability is the industry-preferred standard for documentation and compliance.

Why should you consider moving to digital PDFs?

- Timestamp Verification: Emailing a secure PDF establishes a legal "Received Date," which starts the clock for your "Net 30" payment terms.

- Immutability: A PDF generated by a tool like ours cannot be easily altered by the client, preventing fraud.

- Integration: Digital invoices can be directly imported into accounting software, reducing friction for your client's AP department.

Handling Change Orders & Scope Creep

"Scope Creep" destroys profitability. The golden rule of construction management is: No ticket, no payment. Never bill for work that hasn't been documented.

Script: How to Formalize a Verbal Request

If a client verbally asks for extra work on-site, do not just do it. Send this email template immediately to create a paper trail:

Subject: Change Order Confirmation - [Project Address]

Hi [Client Name],

Per our discussion on site today, you have requested we [Description of new task, e.g., install dimmer switches instead of standard toggles].

This falls outside the original contract scope. The additional cost will be $[Amount] for materials and labor. This will be billed as Change Order #01 on the next invoice.

Please reply "Approved" so we can proceed without delay.

On the invoice, this must appear as a distinct line item: "Change Order #01 - Approved via email on [Date]".

Retainage & Cash Flow Management

Retainage (holding back 5-10% of the contract value) is standard in commercial jobs to ensure punch-list completion. However, you must track it, or you will lose it.

🧮 Retainage Accounting Formula

Releasing Retainage

At the end of the job, you must issue a final invoice specifically for the "Release of Retainage." Do not combine this with new work. It should be a clean invoice billing solely for the accumulated withheld amount ($2,000 in the example above), attached to the "Certificate of Substantial Completion."

The Documentation Packet

Professional contractors do not send a single page. They send a Packet. To ensure your invoice is processed without "Request for Information" (RFI) delays, include:

- The Invoice: The cover sheet with totals.

- Schedule of Values (G703 style): A breakdown of percentage complete per line item.

- Conditional Lien Waiver: A document stating, "Upon receipt of $X, I waive lien rights for this amount." This is the #1 document that speeds up payment.

- Site Photos: Proof of work completed (especially for work that gets covered up, like plumbing or wiring).

Troubleshooting: What if the Invoice is Rejected?

Invoices are rarely rejected because of the price; they are rejected because of Format or Compliance. If a General Contractor kicks back your invoice:

- Check the Math: Is the 'Previous Billed' amount matching exactly what they paid last month? Rounding errors of even $0.01 can cause rejection in software systems.

- Verify the Waiver: Did you sign and notarize the Lien Waiver?

- Review the Period: Are you billing for work done after the billing cutoff date (e.g., the 25th of the month)? Remove it and bill it next cycle.

Frequently Asked Questions

Is separating labor and materials legally required?

In strict auditing environments and many tax jurisdictions (US, UK, Canada), yes. Failure to separate them often results in the entire invoice being taxed at the highest rate, or worse, triggers a sales tax audit. It is considered an Industry Best Practice for liability protection.

How do I legalize a verbal change order?

Stop work immediately until a written confirmation is received. Even a text message or email reply stating 'I approve the additional $500 for the lighting' creates a paper trail. Attach this proof to your invoice as a supporting document.

When should I send the Lien Waiver?

The 'Conditional Lien Waiver' should be sent WITH the invoice. This tells the client: 'Once this check clears, I waive my lien rights for this amount.' This speeds up payment significantly compared to sending it afterwards.

What is the 2026 standard for invoice delivery?

Digital delivery is now the industry preference. The recommended standard is a secure, tracked PDF sent via email or client portal. This establishes a digital timestamp proving exactly when the client received the bill, which is crucial for enforcing 'Net 30' terms. Paper invoices remain legally valid but digital provides better documentation.

Can I charge interest on late payments?

Only if your original contract and your invoice terms clearly state it. The standard industry clause is '1.5% per month on overdue balances,' but this must be visible on every document from day one.