How to Issue a Flawless Corporate Invoice

Follow this protocol to ensure your invoice is processed in the first payment run (Net 30/60).

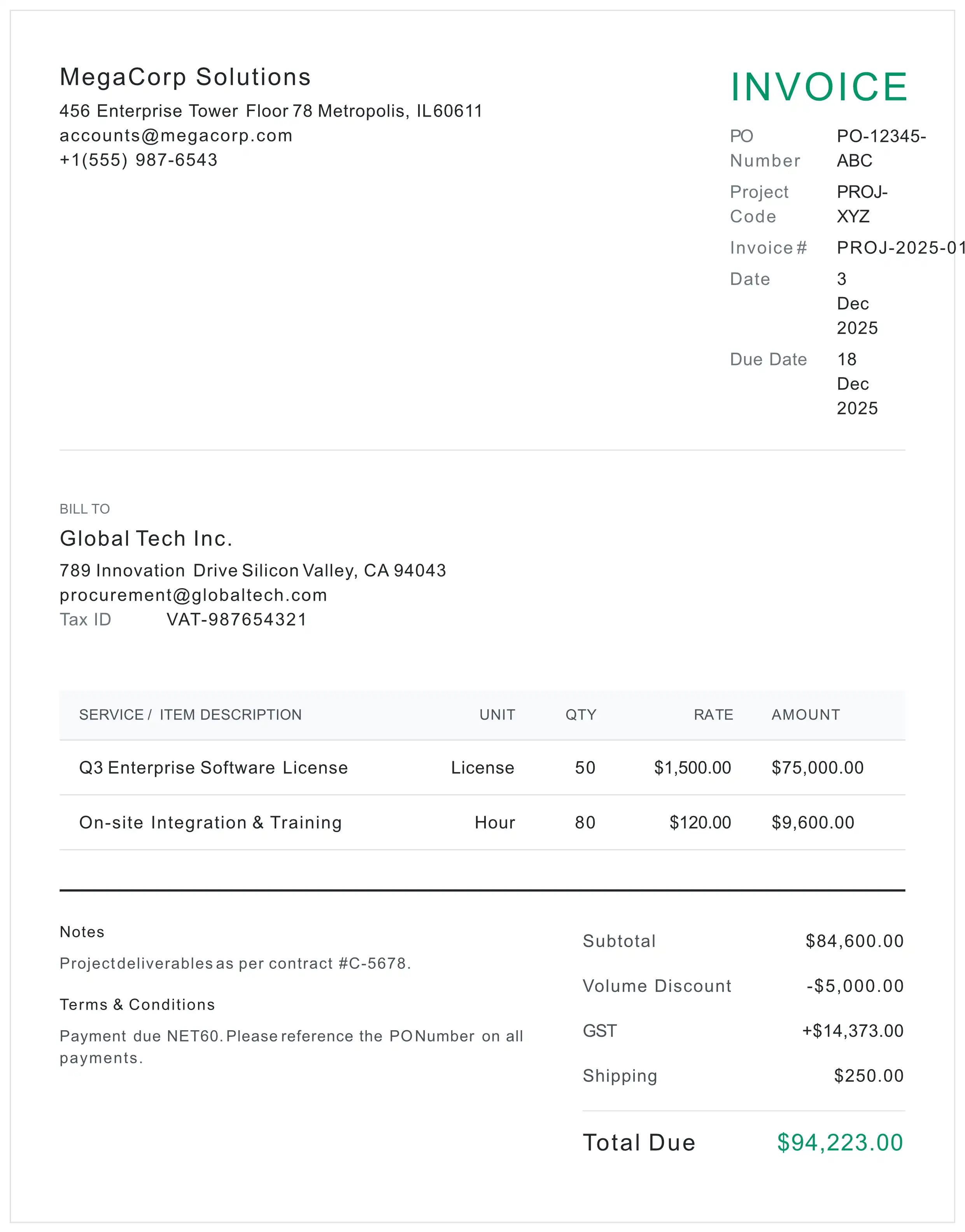

Ensure your 'Bill To' matches the exact legal entity name of your client to avoid AP rejection.

Enter the Purchase Order number provided by the client. This is the primary key for payment release.

Fill in Tax IDs for both parties. For EU/UK clients, ensure VAT numbers are visible.

Break down services clearly (Quantity x Rate). Vague descriptions trigger audit flags.

Click generate to process the document via our secure, ephemeral engine and download the PDF/A file.