"As a consultant billing US clients from Europe, missing the 'Intermediary Bank' field used to cost me weeks in delays. This template solves that perfectly."

Berlin, Germany

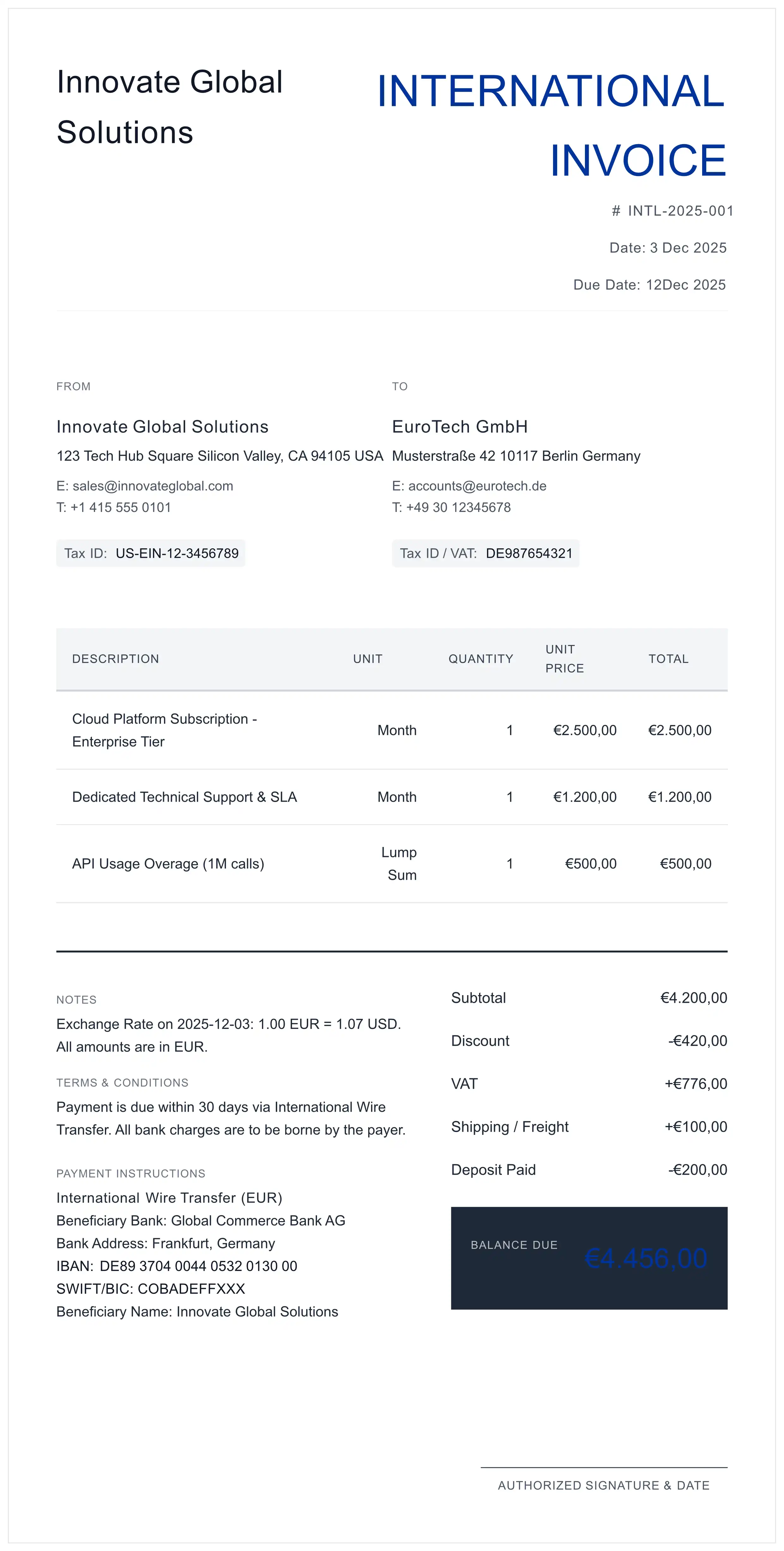

Create professional invoices in USD, EUR, GBP, JPY or 180+ currencies.

Built for SWIFT/BIC accuracy and cross-border banking compliance.

No signup required. Instant PDF download. Zero Data Retention.

Legal Disclaimer: This tool is provided for informational and illustrative purposes only and does not constitute legal, tax, or financial advice. While designed to follow ISO standards, users are solely responsible for ensuring compliance with local laws, correct application of Withholding Taxes (WHT/VAT), and adherence to international trade sanctions (e.g., OFAC, EU lists). The providers of this tool assume no liability for payment delays, regulatory penalties, or financial losses resulting from the use of these documents. Always consult a qualified professional for cross-border transactions.

Standard invoices fail at cross-border payments. We focus on the technical details that ensure you get paid.

Beyond just symbols. We support proper formatting for USD, EUR, GBP, JPY and more. The layout adapts to ensure clear communication of the debt amount.

Domestic templates lack space for SWIFT/BIC codes. Our layout prioritizes these fields, crucial for wire transfers to route correctly through the banking network.

Automated Accounts Payable systems need to read your invoice. Our PDFs are vector-based, ensuring data extraction is 100% accurate without OCR errors.

In international wire transfers (especially USD), money rarely moves directly from Bank A to Bank B. It often passes through a Correspondent/Intermediary Bank.

The Solution: Use the "Payment Methods" or "Notes" section of this generator to explicitly list:

Different regions use different separators for thousands and decimals. Using the wrong one can lead to 100x payment errors.

| Region / Currency | ISO Code | Format Standard | Visual Example |

|---|---|---|---|

| United States | USD | Dot (.) for decimal | $1,250.50 |

| European Union | EUR | Comma (,) for decimal | 1.250,50 € |

| United Kingdom | GBP | Dot (.) for decimal | £1,250.50 |

| Japan | JPY | No decimals (typically) | ¥125,050 |

*Our tool helps you present these clearly, but always verify your specific client's preference in the 'Notes' section.

Yes. Our generator adheres to ISO 4217 standards for currency codes (e.g., using 'USD' alongside '$') and correct decimal formatting logic. This ensures your invoice is recognized by automated banking software globally.

This is a common dispute in international billing. We recommend using the 'Notes' section of this generator to specify 'All bank charges to be paid by the payer' (OUR) to ensure you receive the full amount. If unspecified, banks often default to 'SHA' (Shared), meaning you receive less than invoiced.

For non-US bank accounts receiving USD, an intermediary bank is often required. You can enter these details in the 'Payment Instructions' or 'Notes' field. Include the Intermediary Bank Name and their SWIFT/BIC code to prevent payment rejection.

Yes. Unlike image-based invoices, our PDF output is vector-based and text-selectable. Accounts payable teams can copy-paste your IBAN and SWIFT codes directly into their banking portal, reducing transcription errors.

Our generator supports all 180+ currencies defined by ISO 4217, including major currencies (USD, EUR, GBP, JPY, CAD, AUD, CHF) and emerging market currencies (CNY, INR, BRL, MXN). The system automatically applies correct decimal formatting and symbol placement for each currency.

Yes. This generator is ideal for freelancers billing international clients. It includes fields for IBAN, SWIFT/BIC codes, and intermediary bank details that ensure wire transfers route correctly. You can also specify fee responsibilities (OUR/SHA/BEN) to avoid payment deductions.

Need help with cross-border billing? Read our complete guide to international invoicing.

Don't let bad formatting delay your payment. Create a banking-standard invoice in seconds.

Generate ISO Invoice Now