Three Pricing Models: Hourly, Retainer, and Value-Based

The billing methodology selected impacts not only profitability but also the perception of authority. For modern consultancies, evolving from "Time & Materials" to strategic partnerships via Retainer or Value-based models is the standard trajectory for scalability.

Hourly Billing

Time & Materials. The baseline model for initial engagement. It offers transparency but caps revenue at maximum billable hours. Similar to freelance invoicing, hourly billing works best for undefined scope projects.

$80k Target ÷ 15 billable hrs/week ≈ $121/hr

Retainer Model

Fixed Recurring Fee. Ensures availability and stabilizes cash flow. Highly preferred for long-term advisory roles.

Predictable Monthly Revenue (MRR).

Value-Based

Outcome Oriented. Pricing is anchored to the client's ROI rather than time input. Represents the highest margin potential.

Decouples income from time.

Financial best practices dictate defining a clear 'Rollover Policy' in the Master Service Agreement (MSA). Data suggests that a 'Use-it-or-lose-it' policy prevents liability accumulation on the balance sheet and encourages consistent client engagement.

Requirement: Retainer contracts often require "Flat Fee" line items. Generate a compliant Invoice via our Tool.

Model Comparison Matrix

Selecting the appropriate model depends on the project phase and client relationship maturity. Below is a comparative analysis based on industry benchmarks.

| Model | Primary Metric | Financial Advantage | Ideal Usage Case |

|---|---|---|---|

| Hourly | Time Input | Low Risk / Full Compensation | Short-term, undefined scope projects. |

| Retainer | Availability | Cash Flow Stability | Maintenance, advisory, and ongoing support. |

| Value-Based | Client ROI | High Margin Scalability | High-impact strategic transformations. |

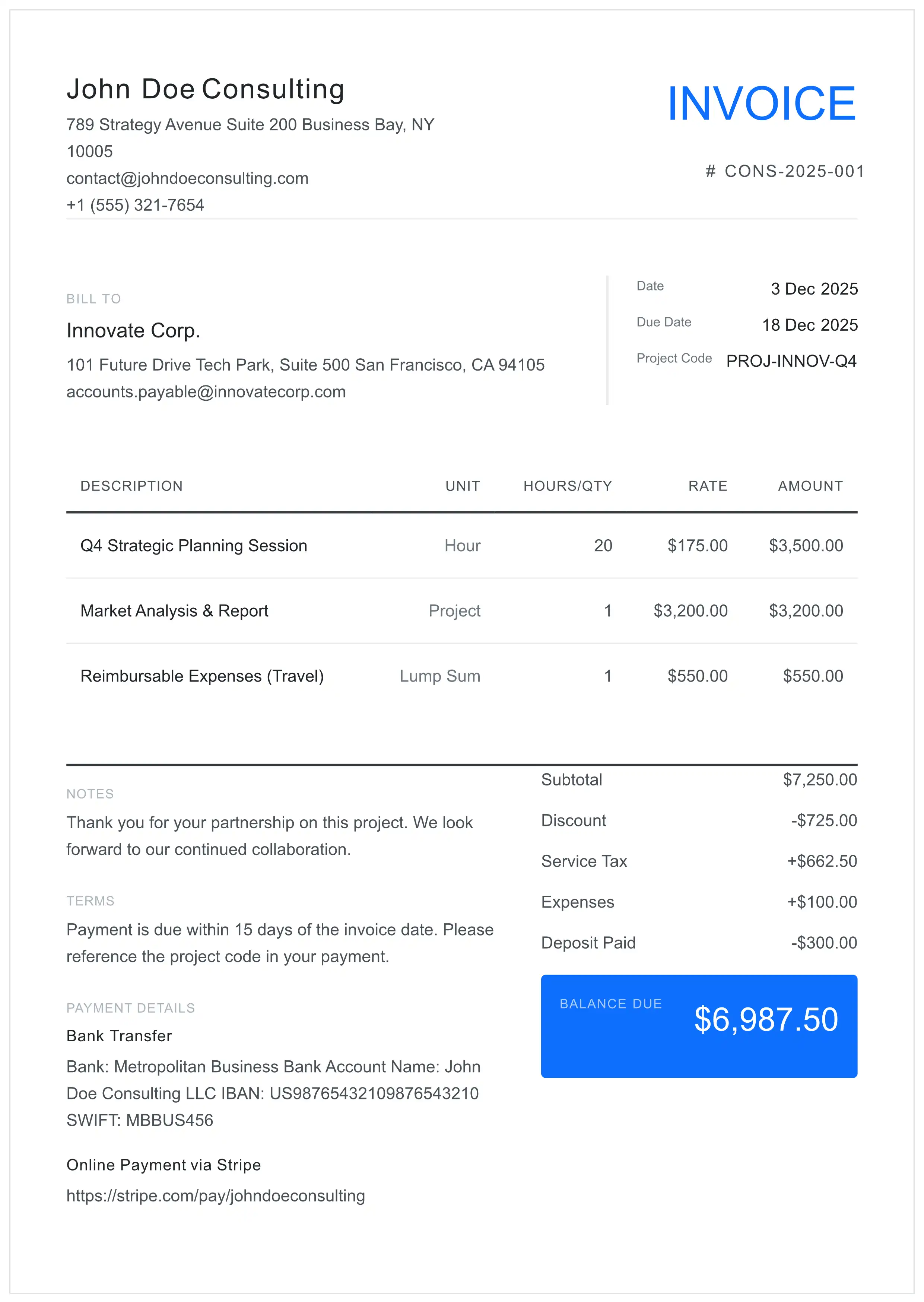

Anatomy of a Compliant Invoice

For consultants engaging with corporate entities, the invoice functions as a legal demand for payment. It must satisfy strict Accounts Payable (AP) validation rules. Incomplete documentation is the leading cause of payment delays (DSO).

Essential Compliance Fields

The Purchase Order (PO) Number is mandatory for most enterprises. Automated Optical Character Recognition (OCR) systems used by AP departments will often reject invoices missing this field automatically.

Technical Requirements for Approval:

- Service Itemization: Avoid generic terms like "Consulting Services". Audit trails require specificity (e.g., "Q4 Financial Analysis - 15 Hours @ $150/hr").

- Payment Terms: Clearly state terms (e.g., Net 15, Net 30). Ambiguity here renders late fees unenforceable.

- Tax Identification: Your EIN (US) or VAT ID (Global) must be prominently displayed for the client's tax deduction compliance.

Global Compliance & E-Invoicing (2026 Standards)

With the rise of remote consulting, cross-border billing has become standard. However, it introduces complex compliance layers.

- E-Invoicing Protocols: Many jurisdictions now mandate standardized electronic invoicing formats (XML, UBL) over PDF. The EU follows the EN 16931 standard, with formats like Peppol BIS, UBL 2.1, and UN/CEFACT CII becoming mandatory for B2B transactions in countries like Belgium, France, and Germany by 2026-2027. Ensure your invoicing software is capable of generating structured data to meet these requirements.

- VAT/GST Reverse Charge: When billing internationally within the EU, understand the "Reverse Charge Mechanism". For intra-EU B2B transactions (e.g., France to Germany), the supplier may invoice without VAT, and the buyer self-accounts for VAT in their country, provided both VAT IDs are validated and recorded. Note: The USA does not use VAT; different sales tax rules apply.

- Currency Specifications: Always specify the currency code (USD, EUR, GBP) explicitly to avoid forex discrepancies in payment. Use our multi-currency invoice generator for international clients.

Handling Reimbursable Expenses

Reimbursable expenses must be treated with high transparency to pass audit. According to IRS tax guidelines, commingling expenses with service fees can complicate tax deductions.

- Segregation: Expenses should be listed as distinct line items, separate from labor fees.

- Pass-Through Policy: The standard industry practice is to pass costs at face value. Any administrative markup (typically 5-10%) must be pre-stipulated in the contract.

- Digital Proof: Attach a consolidated PDF of receipts for any single expense exceeding $75 (or the local currency equivalent). Note: The IRS requires receipts for lodging expenses regardless of amount.

✅ The AP-Approval Checklist

Before transmission, verify the invoice against this protocol to minimize rejection probability.

- Reference Validation: Is the PO Number or Project Code visible in the header?

- Entity Verification: Is the "Bill To" address the legal entity name, not just the trading brand?

- Fiscal Compliance: Are Tax IDs (Sender and Receiver) correct?

- Banking Integrity: Are SWIFT/IBAN or Routing numbers accurate for the payment method?

- Scope Alignment: Do billed items match the signed SOW or Change Order?

Contractual Protections: Scope & Late Fees

The invoice is the enforcement mechanism of the contract. Without explicit terms, collecting payment for "Scope Creep" (unauthorized project expansion) is legally difficult.

Managing Scope Creep

Scope creep is a primary diluter of consulting margins. Best practices dictate that no additional work should commence without a written estimate or Change Order. The invoice should explicitly reference "Change Order #X" for any out-of-scope billing.

Standard Late Fee Clause (For Terms Section):

"Payment terms are Net 30. Accounts not paid within 30 days of the invoice date are subject to a 1.5% monthly service charge (18% per annum) or the maximum allowed by law, whichever is less."

Professional Billing FAQs

Which pricing model minimizes risk for new consultancies? +

The Hourly Billing model minimizes initial risk by ensuring all time spent is compensated. However, transitioning to a Retainer model within the first 12 months can significantly improve cash flow predictability by providing guaranteed monthly revenue.

What is the industry standard calculation for billable rates? +

The 'Rule of Thirds' is the standard benchmark: One-third for salary, one-third for expenses/taxes, and one-third for profit margin. A simplified formula involves dividing the target gross revenue by projected billable hours (typically 1,500 hours/year for full-time consultants).

How should scope creep be documented for audit trails? +

Scope creep must be managed via a formal 'Change Order' document. Financial auditors require that any work exceeding the original Statement of Work (SOW) be invoiced as a separate line item referencing the signed Change Order number.

Are late fees enforceable in corporate contracts? +

Yes, provided they are stipulated in the original contract and reiterated on the invoice. Commercial late fee rates typically range from 1% to 2% per month (12-24% APR). However, maximum allowable rates vary by jurisdiction, so always include 'or the maximum allowed by law, whichever is less' in your terms.