VAT Invoice vs Regular Invoice: Key Differences

Understanding the distinction between a VAT invoice and a regular invoice is critical for compliance. A VAT invoice is a statutory tax document that enables input tax recovery, while a regular invoice is simply a commercial record of a transaction.

| Feature | Regular Invoice | VAT Invoice |

|---|---|---|

| VAT Registration Number | Not required | Mandatory |

| Tax Breakdown | Not required | Must show VAT rate & amount separately |

| Customer VAT Number (B2B) | Optional | Required for cross-border |

| Legal Status | Commercial document | Statutory tax document |

| Input Tax Recovery | Not possible | Enables VAT reclaim |

8 Mandatory VAT Invoice Fields (Global Standard)

While local nuances exist, the OECD and major tax directives align on these 8 core data points required for a document to be considered a valid VAT invoice. Missing any of these fields can invalidate your invoice for tax recovery purposes.

| Data Attribute | Compliance Requirement |

|---|---|

| 1. Sequential Invoice ID | Must be unique and sequential. Gaps in numbering sequences trigger audit flags for suppressed income. |

| 2. Time of Supply (Tax Point) | The date the transaction occurred legally, which determines the VAT return period. |

| 3. Supplier Tax Identity | Full Legal Name, Registered Address, and VAT/GST/ABN Number. |

| 4. Customer Tax Identity | Mandatory for B2B transactions, especially for Cross-Border/Reverse Charge validation. |

| 5. Line Item Specifics | Detailed description of goods/services (generic terms like "Consulting" are often rejected). |

| 6. Net Value (Pre-Tax) | The taxable amount per line item, expressed in the supplier's functional currency. |

| 7. Applied Tax Rate & Amount | The exact tax value. In multi-currency invoices, the Tax Amount must be converted to the supplier's local currency. |

| 8. Total Gross Amount | The final payable sum (Net + Tax). |

Simplified VAT Invoice (UK: Under £250)

In the UK, HMRC allows a simplified VAT invoice for retail sales under £250 (including VAT). This reduces the mandatory requirements and streamlines transactions for small purchases.

Simplified Invoice Must Include:

- Supplier's name and address

- Supplier's VAT registration number

- Date of supply (tax point)

- Description of goods/services

- Total amount payable (including VAT)

- VAT rate applied

Can Be Omitted:

- Customer's name and address

- Unique invoice number (though still recommended)

- Separate VAT amount calculation

Note: Simplified invoices are primarily used in retail environments. For B2B transactions or amounts over £250, a full VAT invoice is required. You can generate a compliant VAT invoice using our free tool.

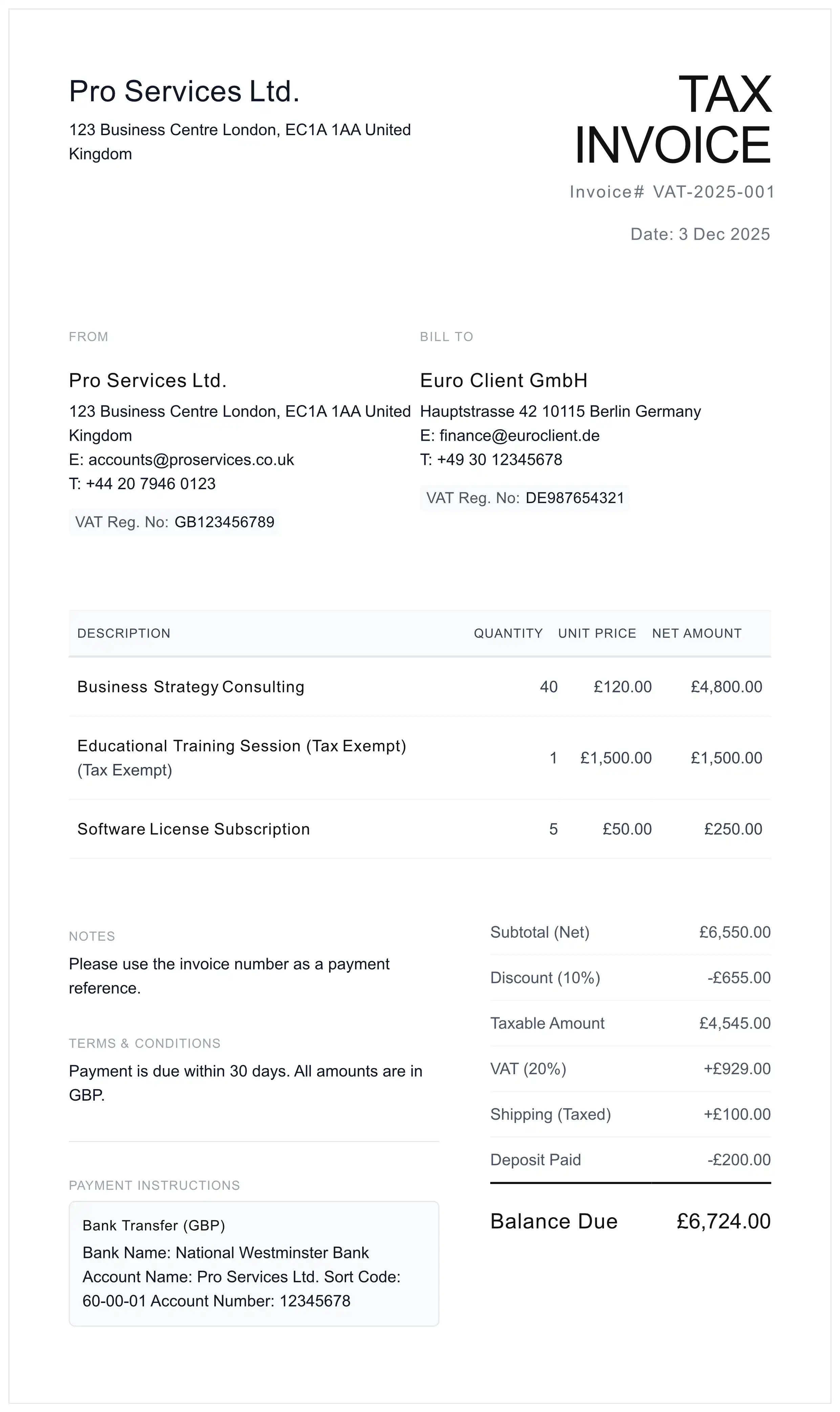

Anatomy of a Compliant Invoice

The visual structure of an invoice must facilitate rapid auditing. Below is an example generated by our system that separates tax components to meet strict accounting standards.

Country-Specific VAT Rules: UK, EU, Australia & Canada

Compliance is location-dependent. Below are the critical references for major jurisdictions as of 2026.

🇬🇧 United Kingdom (HMRC)

- Regulation: HMRC VAT Record Keeping.

- MTD: "Making Tax Digital" requires digital record-keeping. Handwritten invoices are largely obsolete for VAT-registered businesses.

- Simplified Invoice: Allowed for retail sales under £250.

🇪🇺 European Union (VAT Directive)

- Regulation: Council Directive 2006/112/EC.

- Cross-Border: Intra-Community Supply rules apply. Both VAT numbers must be validated via VIES.

- Language: Invoices can be in any language, but tax authorities may request a translation for audit.

🇦🇺 Australia (ATO)

- Regulation: ATO Tax Invoices.

- Threshold: Valid tax invoice required for sales over $82.50 AUD (inc. GST).

- Key Rule: For sales >$1,000, the buyer's identity/ABN must be on the document.

🇨🇦 Canada (CRA)

- Regulation: Excise Tax Act.

- Tax Breakdown: Must clearly separate GST (5%) vs. HST (13-15%) depending on the "Place of Supply" (Province). HST rates: Ontario 13%, Nova Scotia 14%, New Brunswick/Newfoundland/PEI 15%.

- Requirement: The supplier's Business Number (BN) is mandatory.

E-Invoicing Mandates 2026: Peppol & ViDA

The era of the "PDF Invoice" is ending. We are witnessing a global shift towards Continuous Transaction Controls (CTC).

Multiple jurisdictions are mandating E-Invoicing in 2026. This means the invoice is not a document, but a structured data file (XML, UBL, JSON) transmitted directly to tax authorities or via the Peppol network.

| Country | 2026 Mandate | Platform/Format |

|---|---|---|

| Poland | Feb 2026 (large business), Apr 2026 (all VAT-registered) | KSeF (National System) |

| France | Sep 2026 (receiving mandatory, large/mid sending) | Factur-X, UBL, CII |

| Belgium | Jan 2026 (B2B via Peppol) | Peppol BIS |

| Germany | Receiving since Jan 2025, sending by Jan 2027 | XRechnung, ZUGFeRD |

| Malaysia | Jan 2026 (RM1-5M), Jul 2026 (all) | MyInvois (XML/JSON) |

Prepare for ViDA (VAT in the Digital Age):

- Structured Data: Ensure your invoicing software can export to UBL 2.1 or CII standards (EN 16931).

- Real-Time Reporting: 2026 regulations often require invoices to be issued within days of the supply, not weeks.

- EU Milestone: By July 2030, all intra-EU B2B invoices must be electronic under ViDA.

Reverse Charge VAT: Cross-Border B2B Transactions

The Reverse Charge Mechanism shifts the liability to pay VAT from the supplier to the customer. This is the standard for international B2B services (e.g., a UK consultant billing a German company).

Compliance Decision Logic

For more complex cross-border scenarios involving multiple currencies, see our International Invoicing Guide or use our Multi-Currency Invoice Generator.

Common VAT Invoice Mistakes & Penalties

Auditors look for specific patterns to disallow input tax. Ensure you avoid these critical errors:

- Calculation on Gross: VAT is calculated on the Net amount. Calculating it on the Gross amount results in over/under payment.

- Invalid VRN: Using a fake or expired VAT number (especially for Reverse Charge) is considered tax fraud. Always validate foreign IDs.

- Currency Errors: For foreign currency invoices (e.g., USD invoice from a UK entity), the VAT Amount must be stated in GBP using the daily official exchange rate.

- Wrong Entity Billing: Invoices addressed to "The Group" instead of the specific legal entity holding the VAT registration will be rejected for deduction.

- Modification of Issued Invoices: You cannot simply "edit" a sent invoice. You must issue a Credit Note to cancel the original and issue a new corrected invoice. See our Credit Memo Guide for proper procedures.

Digital Services VAT: OSS & IOSS Explained

For B2C sales of digital services (SaaS, e-books, streaming) in the EU, the "Place of Supply" is the consumer's location.

- OSS (One-Stop Shop): Allows you to report all pan-EU B2C sales in a single return, rather than registering for VAT in 27 countries.

- IOSS (Import One-Stop Shop): Used for goods imported into the EU with a value under €150. This streamlines customs clearance.

- Compliance Note: Your invoice must reflect the VAT rate of the customer's country (e.g., 21% for Spain), not your own.

How to Create a VAT Invoice: Step-by-Step

Follow this strict workflow using our generator to ensure no compliance data points are missed.

- Jurisdiction & Status Verification:

Confirm the tax residency of both parties. Check valid Tax IDs.

- Input Registration Data:

Enter your VAT/GST number in the "From" field. If B2B international, the client's ID is mandatory.

- Tax Rate Assignment:

Select the correct rate per line item. Do not mix Exempt and Standard rated items without clear separation.

- Legal Notes & Annotations:

If tax is 0% (Export/Reverse Charge), select the appropriate legal disclaimer from the dropdown.

- Final Rendering:

Generate the PDF. Verify that "Tax Amount" is distinct from "Subtotal". Save for your digital records (6+ years).

Frequently Asked Questions About VAT Invoices

Is the supplier's VAT/GST number mandatory on an invoice?

Yes, without exception in regulated jurisdictions. According to HMRC (UK) and EU Directive 2006/112/EC, a valid VAT registration number is the primary identifier for tax deduction. Omitting this renders the document invalid for input tax recovery.

How does 'Reverse Charge' affect the invoice layout?

For Reverse Charge (B2B Cross-border), you must NOT charge VAT (0% rate). Crucially, you must include the customer's validated VAT number and a specific legal reference text stating: 'Reverse Charge applies - Customer to account for VAT'.

What is the 2026 requirement for E-Invoicing?

Multiple countries are mandating B2B e-invoicing in 2026: Poland (February/April 2026 via KSeF), France (September 2026), Belgium (January 2026 via Peppol), Germany (receiving mandatory since January 2025, sending by 2027), and Malaysia (phased through 2026 via MyInvois). This shifts from PDF invoices to structured data formats (XML/UBL) transmitted via networks like Peppol or national platforms.

What is the difference between Zero-Rated and Exempt?

Legally distinct: 'Zero-rated' goods (e.g., exports) allow you to reclaim input VAT on costs. 'Exempt' services (e.g., finance, insurance) do not allow input VAT reclamation. Misclassifying these is a common audit trigger.

What is a simplified VAT invoice?

A simplified VAT invoice is a shorter version allowed in the UK for retail sales under £250. It requires fewer details than a full VAT invoice, such as omitting the customer's name and address, while still including the supplier's VAT number and the total amount including VAT.

When do I need to issue a VAT invoice?

You must issue a VAT invoice for any taxable supply to a VAT-registered customer (B2B) within 30 days of the supply date. For B2C sales, a VAT invoice is only required if the customer requests one. The invoice must include your VAT registration number and a breakdown of the tax charged.

Disclaimer: This content is for educational and technical reference purposes. Tax legislation (VAT, GST, Sales Tax) is subject to frequent change. We recommend consulting with a chartered accountant or tax advisor for specific business rulings.