Why Payment Terms Are a Legal Necessity

Invoice Payment Terms are not merely polite suggestions; they form the contractual backbone of the B2B exchange. In the absence of signed terms, you are subject to default common laws which often favor the buyer's delay.

Establishing clear terms (e.g., "Net 30") legally defines the Default Date. Without a defined default date, you cannot legally enforce late fees or initiate debt recovery protocols effectively.

🏛️ The "Prompt Payment" Legal Framework

Establishing terms aligns your business with government protections:

- USA: The Prompt Payment Act requires federal agencies to pay interest on overdue invoices.

- UK: The Late Payment of Commercial Debts Act allows you to charge statutory interest + compensation.

- EU: The Late Payment Directive establishes a standard 30-day limit for public authorities.

Strategic Anatomy: Placement for Maximum Visibility

Legal enforceability often hinges on "conspicuousness". Terms hidden in 6pt font may be deemed unenforceable in small claims court.

The Master Glossary: Domestic & Commercial Codes

Industry-standard codes reduce friction by setting immediate expectations for Accounts Payable (AP) departments.

Net 7 / 15 / 30 / 60

Definition: Payment is due the specified number of calendar days (not business days) after the invoice date.

Standard: Net 30 is the global B2B standard. Net 60 is common in Logistics and Manufacturing.

Due Upon Receipt

Definition: The debt is active immediately. Technically, the payment is late the next day.

Best For: Medical services, home repairs, and immediate digital downloads.

PIA (Payment in Advance)

Definition: 100% funds required before work commencement. Essential for solvency protection.

Best For: First-time clients with no credit history or custom fabrication.

EOM (End of Month)

Definition: Payment due date accumulates to the end of the current month.

Best For: Agencies with Retainers to streamline admin work into one monthly transaction.

21 MFI (Month Following Invoice)

Definition: Payment is due on the 21st of the month following the invoice date.

Best For: Recurring subscription models and SaaS billing cycles.

Global Standards: Dealing with International Clients

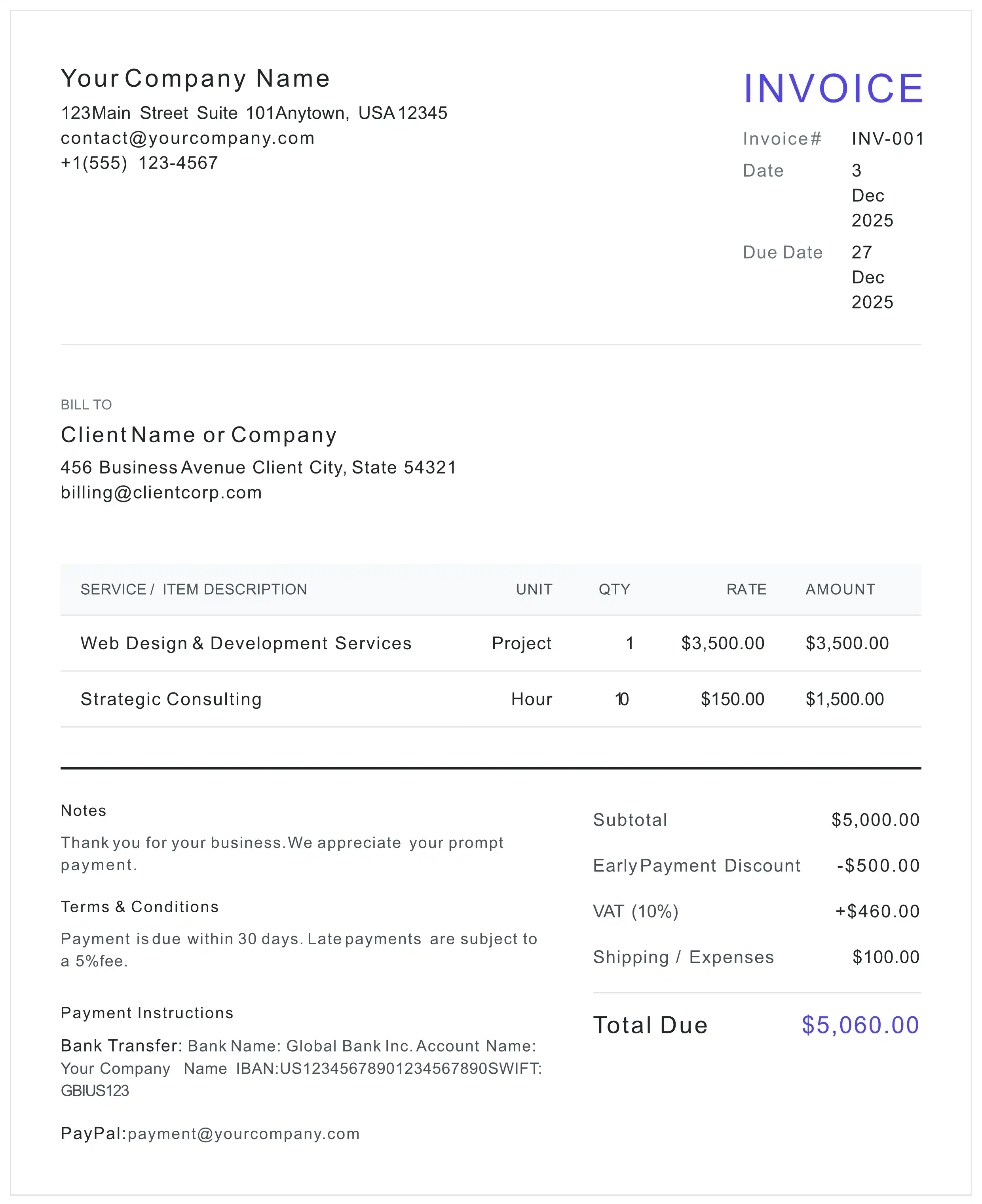

When invoicing across borders in 2026, "Net 30" is insufficient due to banking delays. You must include banking routing codes.

- IBAN (International Bank Account Number): Mandatory for all invoices sent to Europe.

- SWIFT / BIC Code: Required for wire transfers outside the SEPA zone.

- Currency Clause: Explicitly state "Payment to be received in USD, net of all bank transfer fees."

Benchmark: Common Terms by Industry (2026 Data)

Setting terms that deviate too far from industry norms can friction. Use this benchmark table to align your expectations.

Financial Strategy: The "2/10 Net 30" Discount

Cash flow is often more valuable than profit margin. The term "2/10 Net 30" is a classic trade credit agreement.

Calculation: Is it worth it?

- The Deal: Client deducts 2% if paid in 10 days. Otherwise, full amount in 30.

- The Effective APR: By giving up 2% to get money 20 days early, you are effectively paying an APR of ~36%.

Strategy: Use this only when you need immediate liquidity for operations or inventory restocking.

The Psychology of Payment: "Odd Days" Strategy

Data from financial platforms suggests that using standard boilerplate terms causes "Banner Blindness" in AP departments. To get paid faster, break the pattern.

- The "Net 21" Trick: Using an odd number like 13 or 21 days signals that the date is calculated specifically for this project, creating a subconscious urgency.

- Politeness Matters: Invoices containing "Please pay by..." and "Thank you for your business" are paid, on average, 5% faster than those without courtesy phrases.

Calculating Late Fees & Interest (Legally)

Charging interest is a powerful deterrent, but it must be mathematically correct and legally disclosed. A commonly accepted commercial rate is 1.5% per month.

Simple Interest Formula (Non-Compounding)

Fee = (Invoice Total × Annual Rate) ÷ 365 × Days Late Scenario:

Total: $10,000 | Annual Rate: 18% (0.18) | Late: 15 Days

Math: ($10,000 × 0.18) ÷ 365 × 15 = $73.97

⚠️ Compliance Warning: Do not guess your interest rate. Usury laws in New York, California, and EU member states differ. Charging above the legal cap can void your entire invoice. Ideally, stick to the statutory rate defined by your local government.

Late Fee Calculator

Formula: (Invoice Amount x Annual Rate) / 365 x Days Overdue

Professional Collection Scripts (Copy-Paste)

Escalation should be firm but preserve the relationship. We have expanded these scripts to cover the entire lifecycle.

📧 1. The Pre-Deadline "Nudge" (3 Days Before)

Subject: Coming up: Invoice #12345 due on [Date]

Hi [Name],

Hope you're having a great week. This is just a friendly courtesy reminder that Invoice #12345 for [Amount] is scheduled for payment this [Day of Week].

Let me know if you need another copy of the invoice.

Best regards,

📧 2. The Standard Reminder (1 Day Overdue)

Subject: Invoice #12345 is now overdue

Hi [Name],

Our records indicate we haven't received payment for Invoice #12345 yet. It was due yesterday, [Date].

If this has already been sent, please disregard. Otherwise, please remit payment today via [Link].

Thank you,

📧 3. The "Is Everything Okay?" (7 Days Overdue)

Subject: Action Required: Invoice #12345 Outstanding

Hi [Name],

We are now a week past the due date. I wanted to check if there is an issue with the invoice or the banking details provided?

Please let us know immediately so we can resolve any administrative blockers.

Regards,

📧 4. The Payment Plan Offer (15 Days - Empathy Route)

Subject: Regarding outstanding balance for Invoice #12345

Hi [Name],

We value our relationship and understand that cash flow can sometimes be tight. Since this invoice is now significantly overdue, we need to settle the balance to keep your account in good standing.

If paying the full [Amount] today is not possible, please reply to this email so we can agree on a structured payment plan.

Sincerely,

📧 5. The "Final Notice" (30+ Days - Legal Route)

Subject: FINAL NOTICE: Invoice #12345 sent to collections

Hi [Name],

This invoice is now 30 days past due. Despite multiple reminders, we have not received payment or communication.

As per our contract terms, a late fee of [Amount] has been applied. The total due is now [New Total]. If payment is not received by [Date + 3 days], we will be forced to escalate this to [Debt Collection Agency/Legal Counsel].

This is your final notice.

Sincerely,

Frequently Asked Questions (Compliance & Law)

Is 'Net 30' legally binding without a contract?

Generally, invoice terms are enforceable if the client accepts the goods/services knowing these terms apply. However, best practice (and YMYL compliance) dictates explicitly stating these terms in a signed contract or SOW (Statement of Work) before billing.

What is the maximum late fee I can legally charge?

This depends entirely on your jurisdiction's 'Usury Laws'. In many US states, caps exist around 10-18% APR. In the UK, statutory interest is 8% plus the Bank of England base rate. Always consult local statutes.

How do I denote international payment terms?

For cross-border invoices, strictly use ISO currency codes (USD, EUR, GBP) and provide IBAN/SWIFT/BIC codes. Avoid 'Net 30' ambiguity by stating a specific date: 'Due by 30 March 2026'.

What implies 'Time is of the Essence'?

This is a legal clause often added to contracts indicating that late performance (payment) is a material breach of contract, allowing you to terminate services immediately.