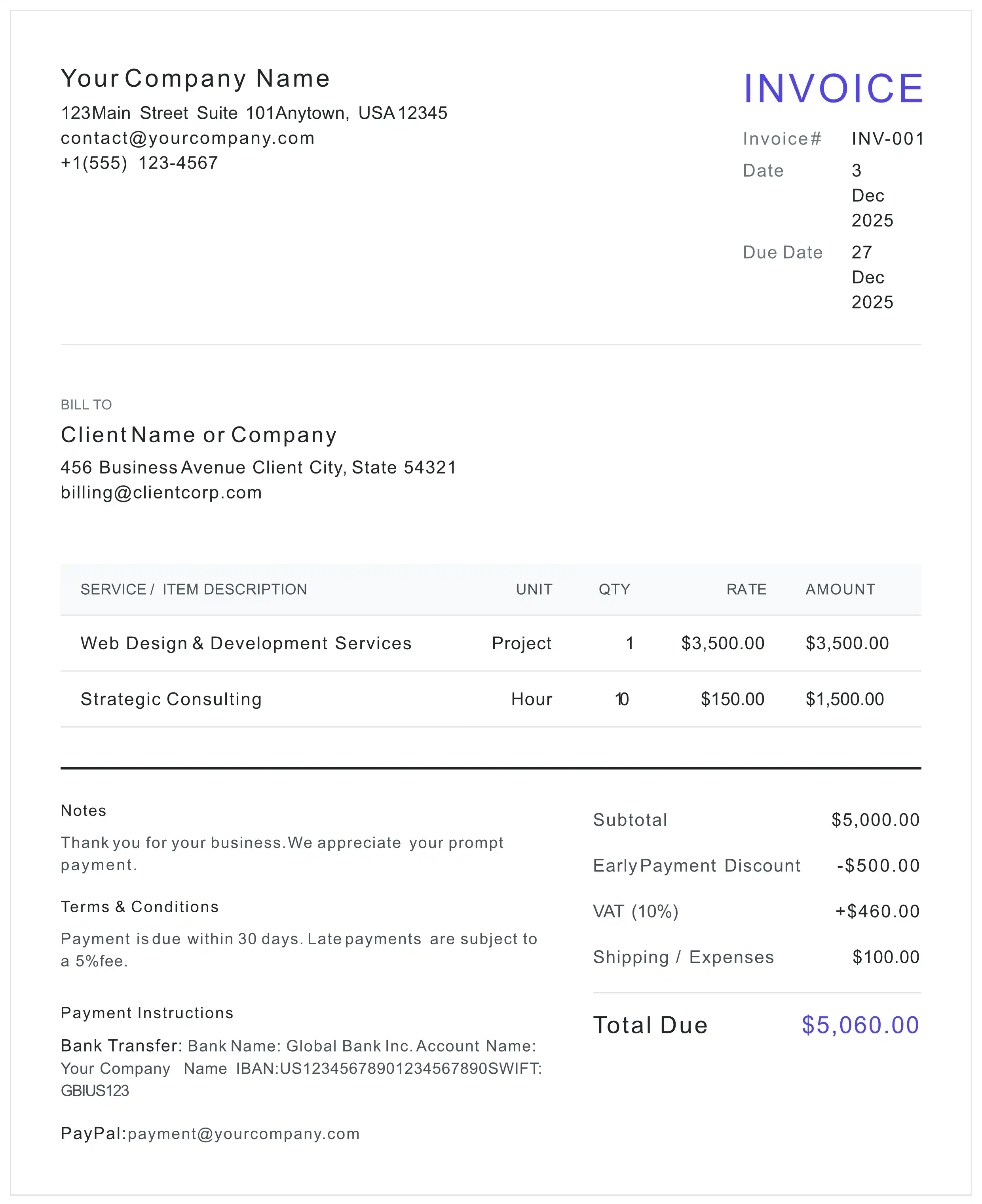

Standard Invoice

Basic billing format for goods and services.

Create This Invoice →Your complete resource library for professional invoicing. Access free guides on invoice creation, VAT/GST compliance, and industry-specific billing.

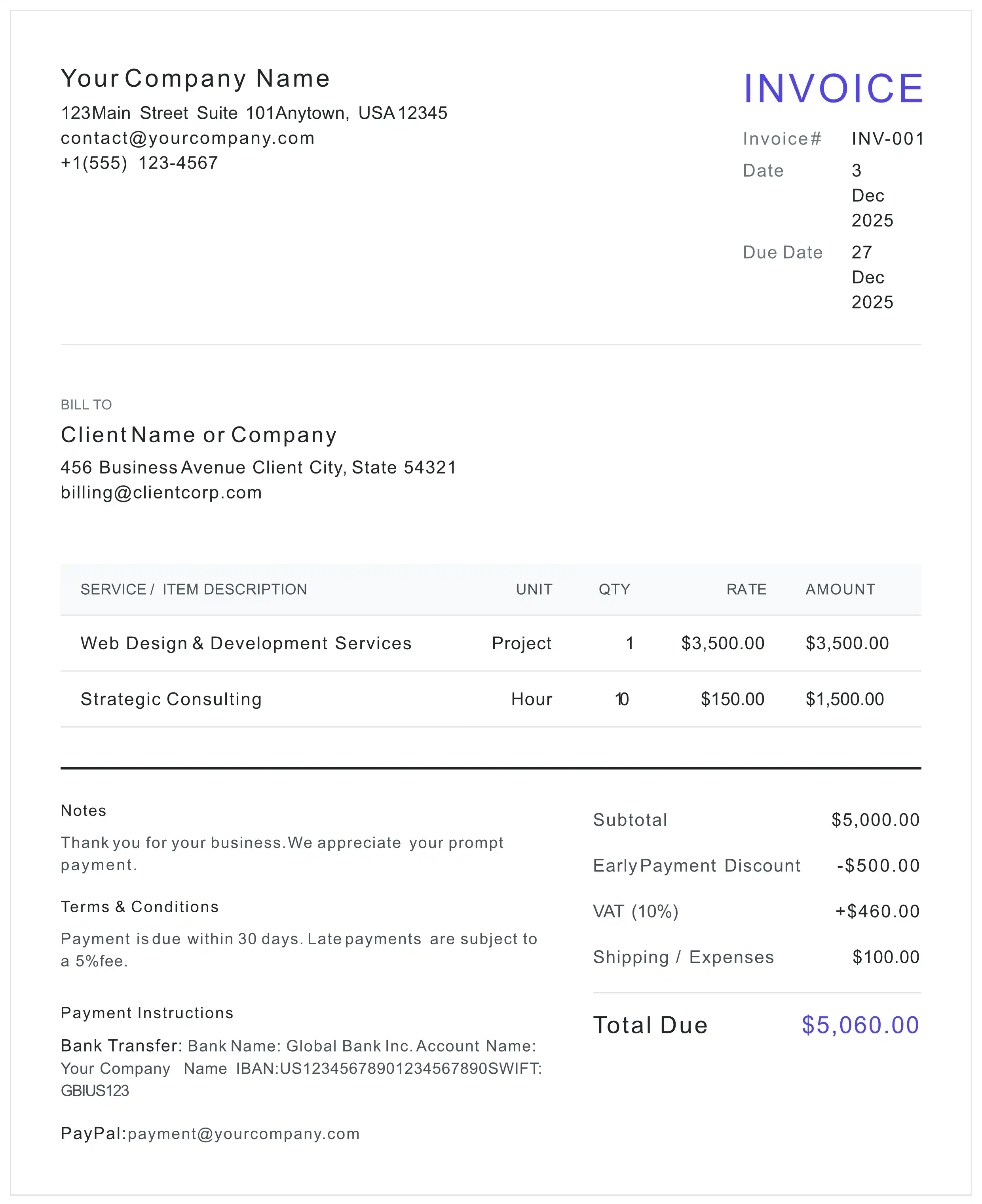

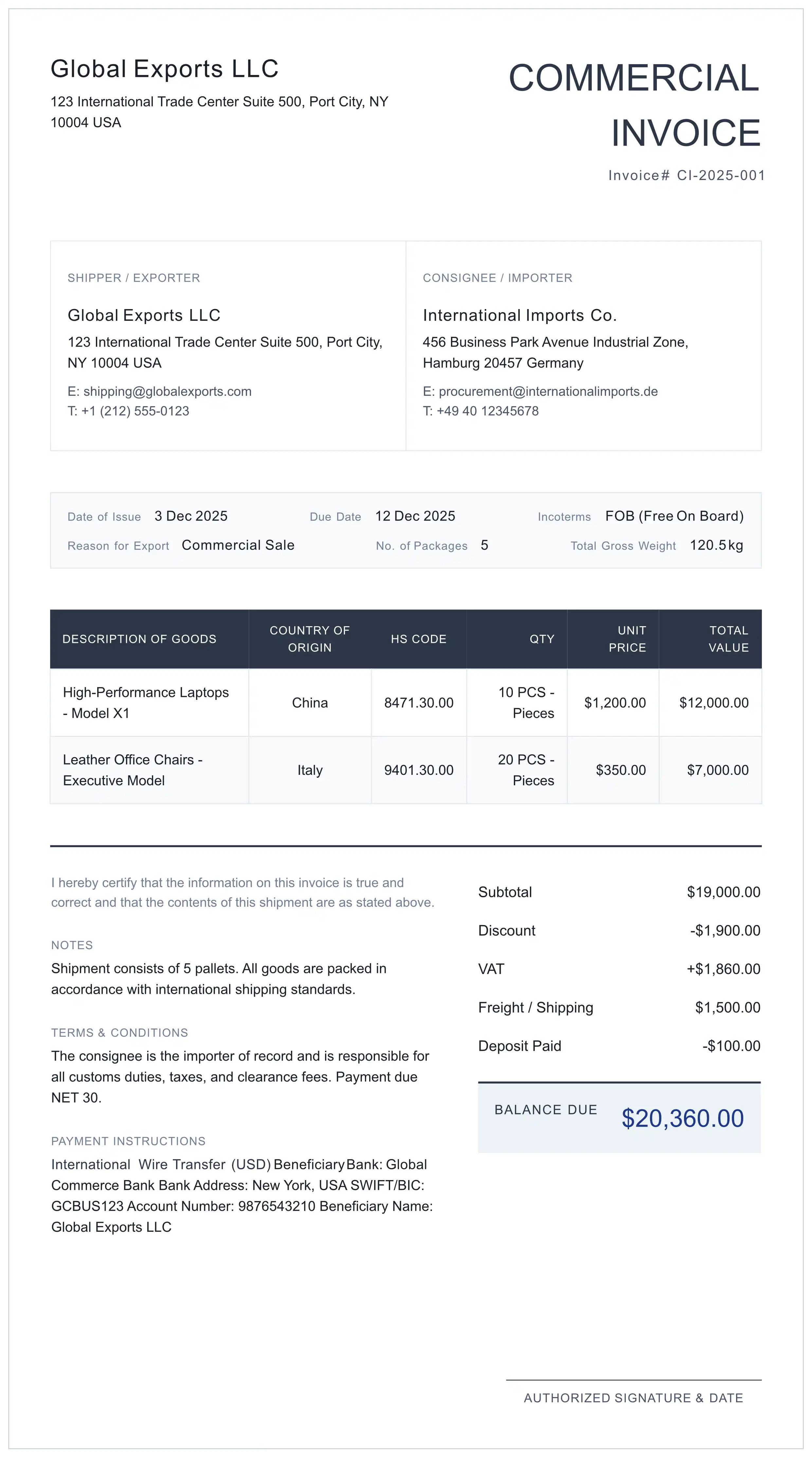

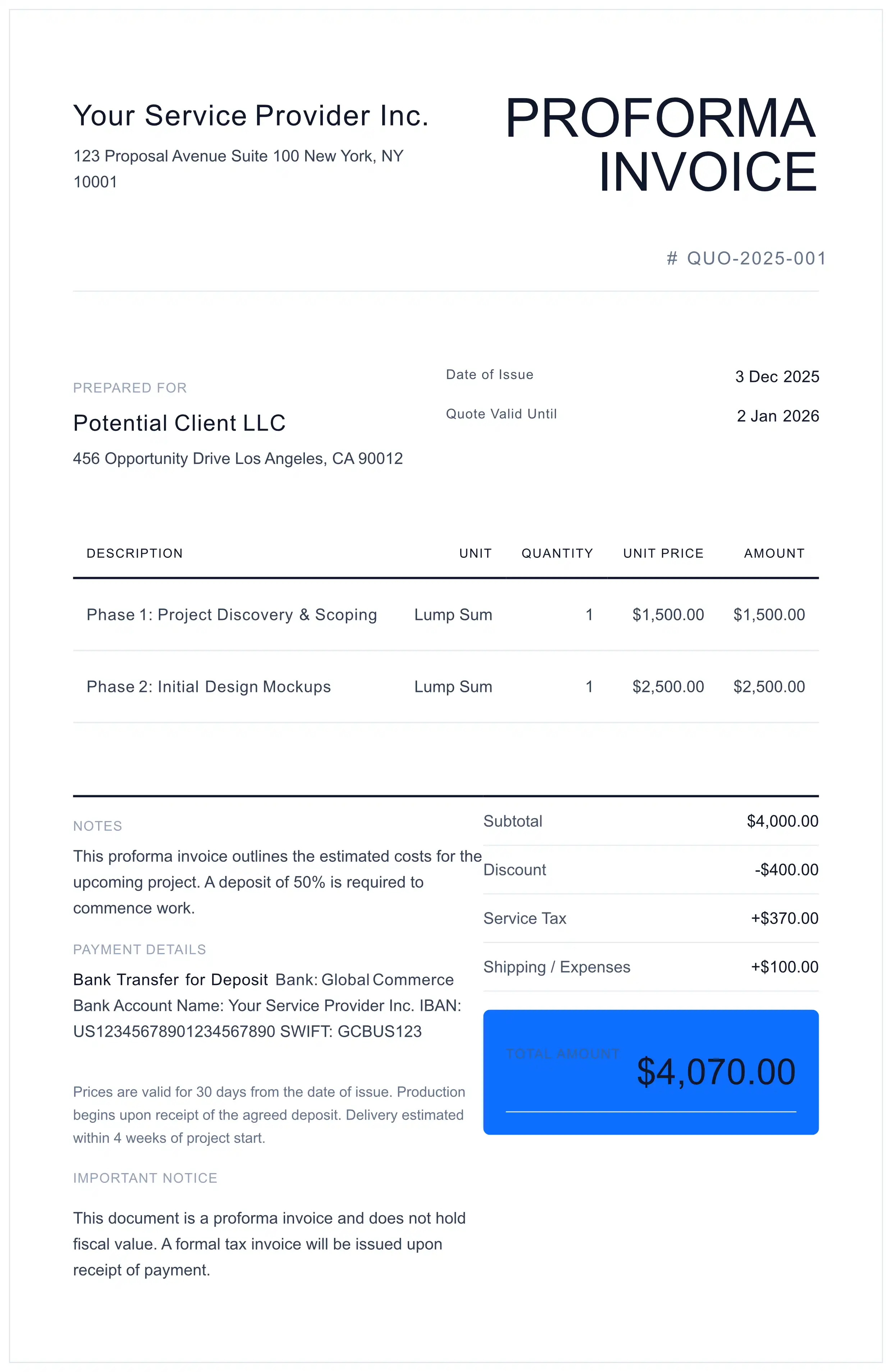

Visual examples of professional invoice formats for different business needs.

Basic billing format for goods and services.

Create This Invoice →

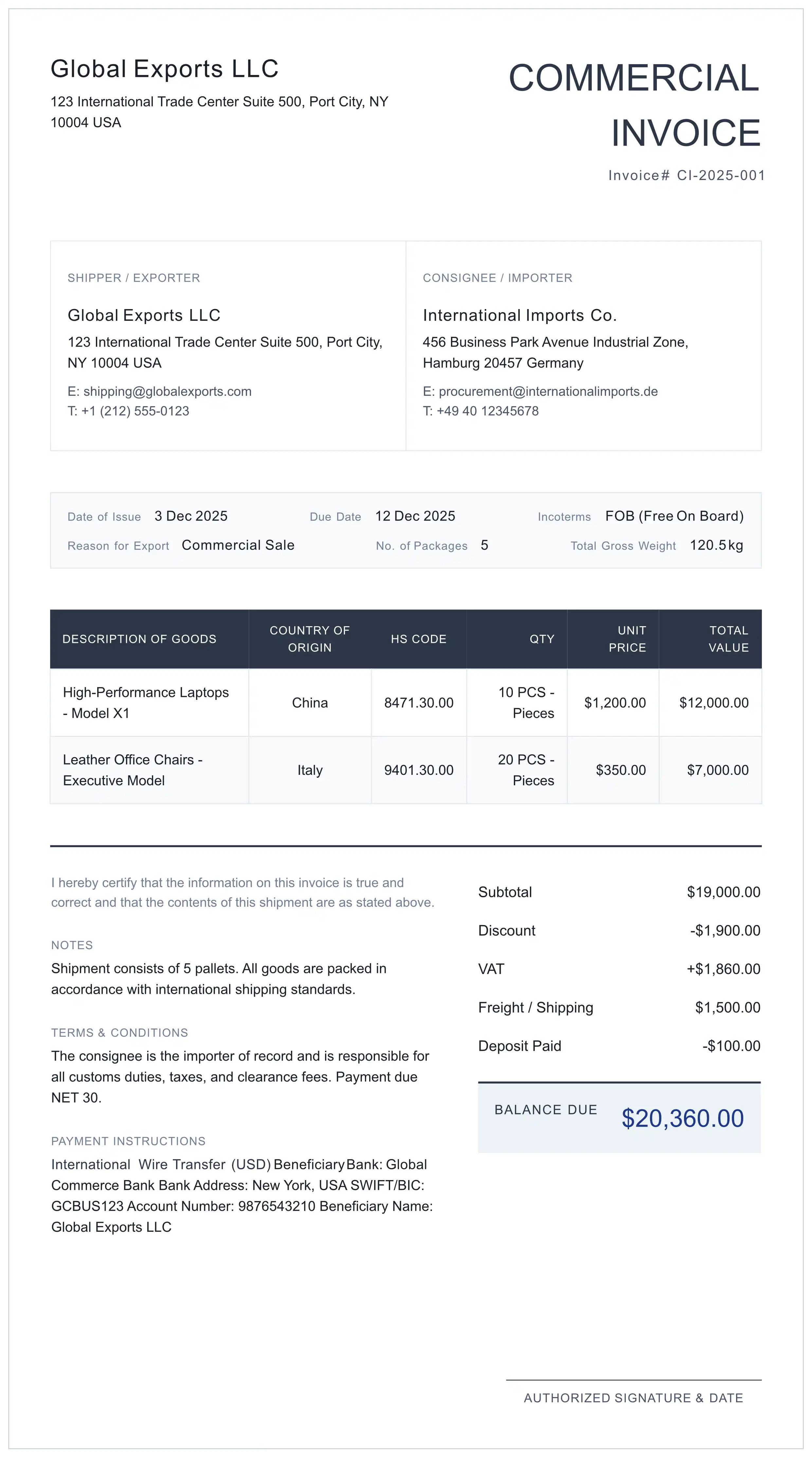

Customs documentation for international exports.

Create This Invoice →

Pre-shipment quote and preliminary billing.

Create This Invoice →

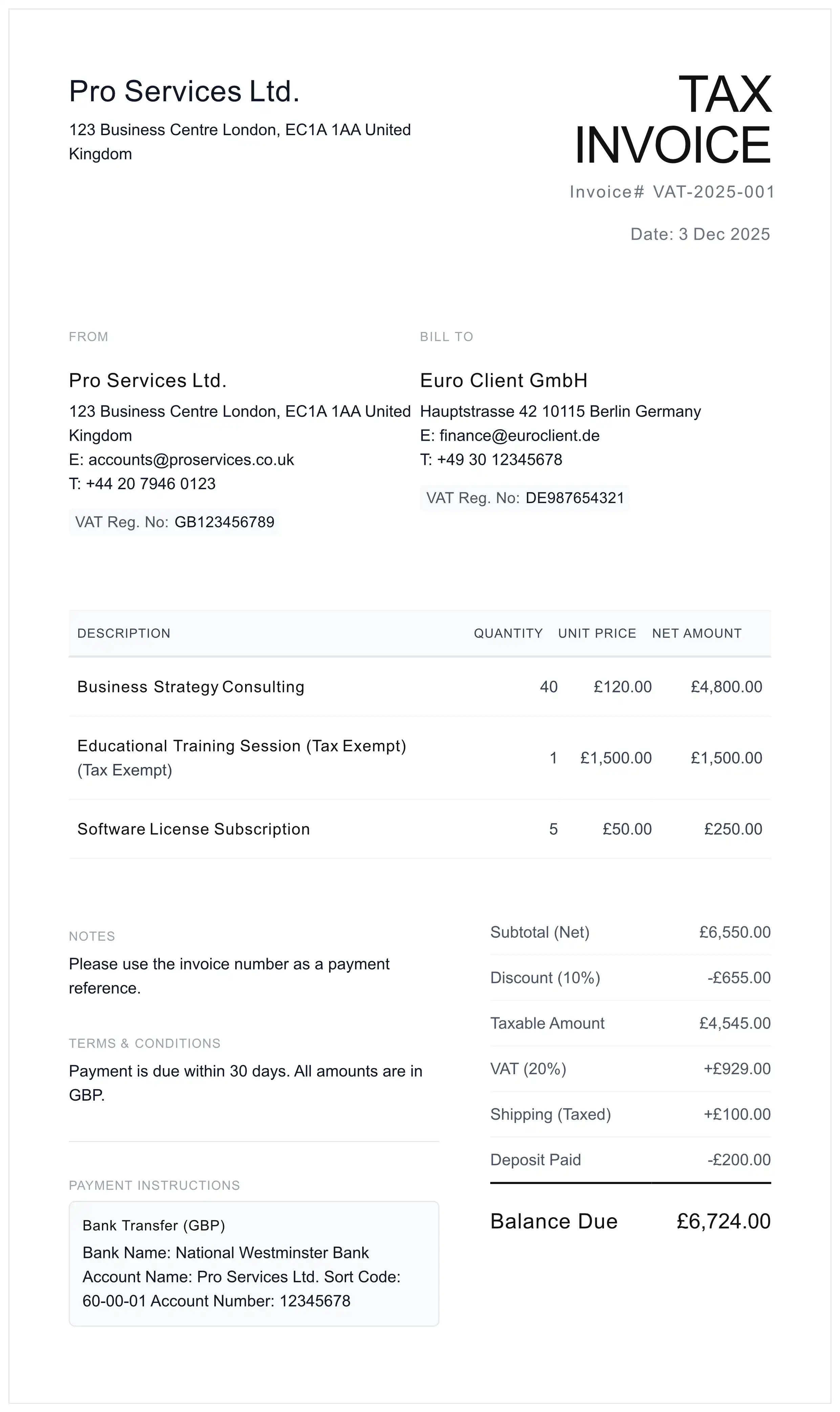

Tax-compliant invoicing for EU/UK businesses.

Create This Invoice →

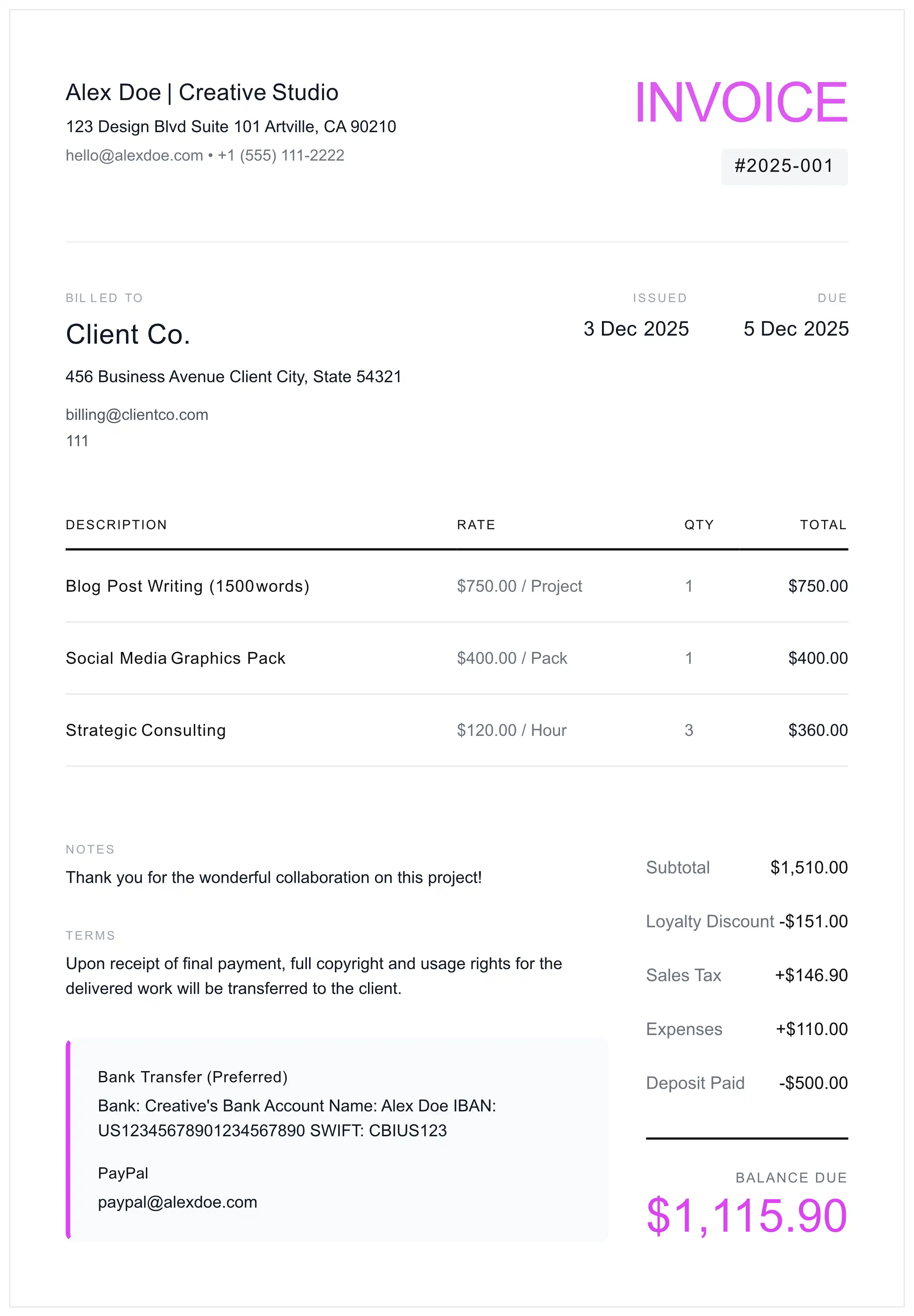

Hourly and project-based billing for freelancers.

Create This Invoice →

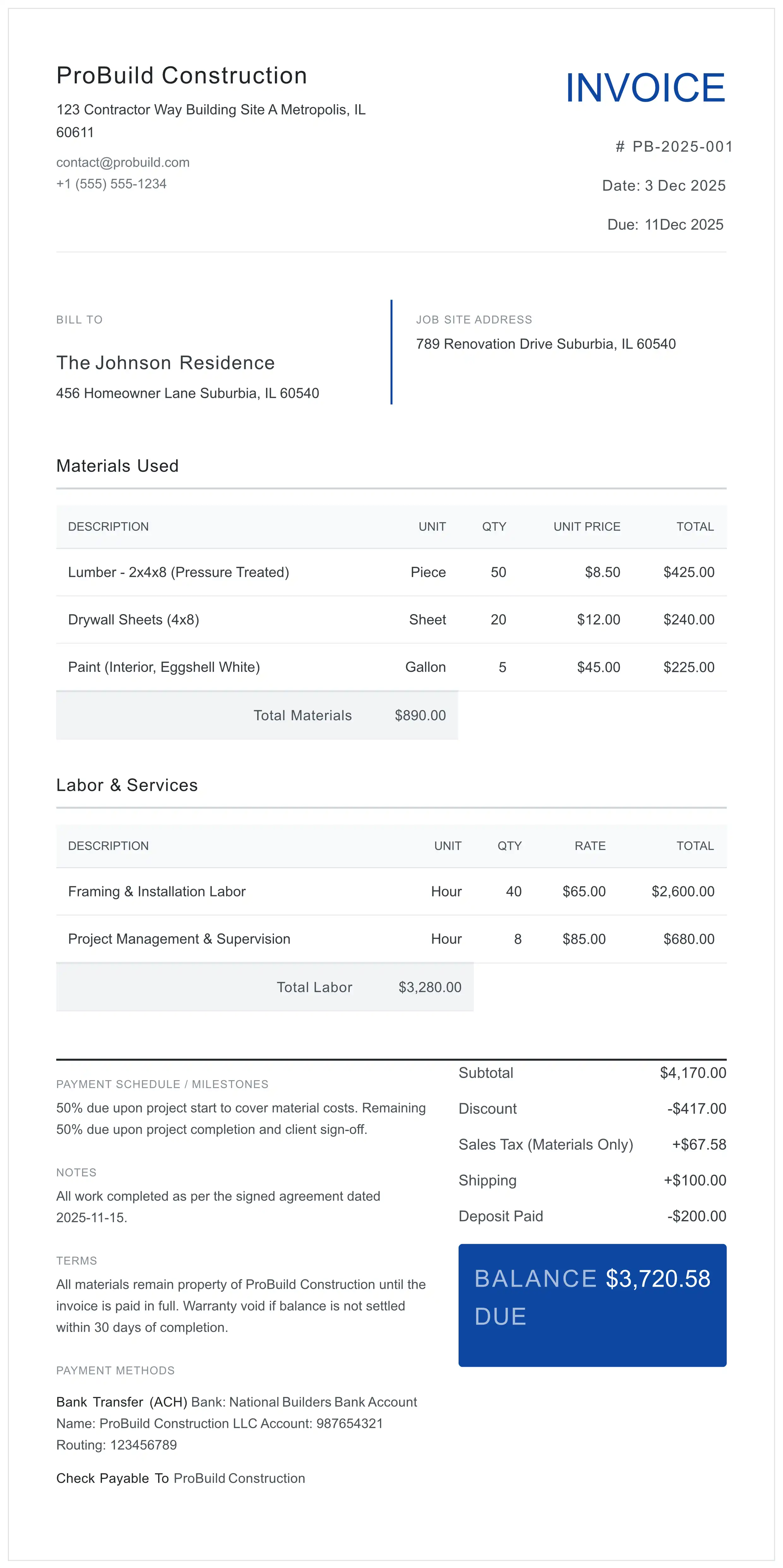

Labor and materials separation for contractors.

Create This Invoice →

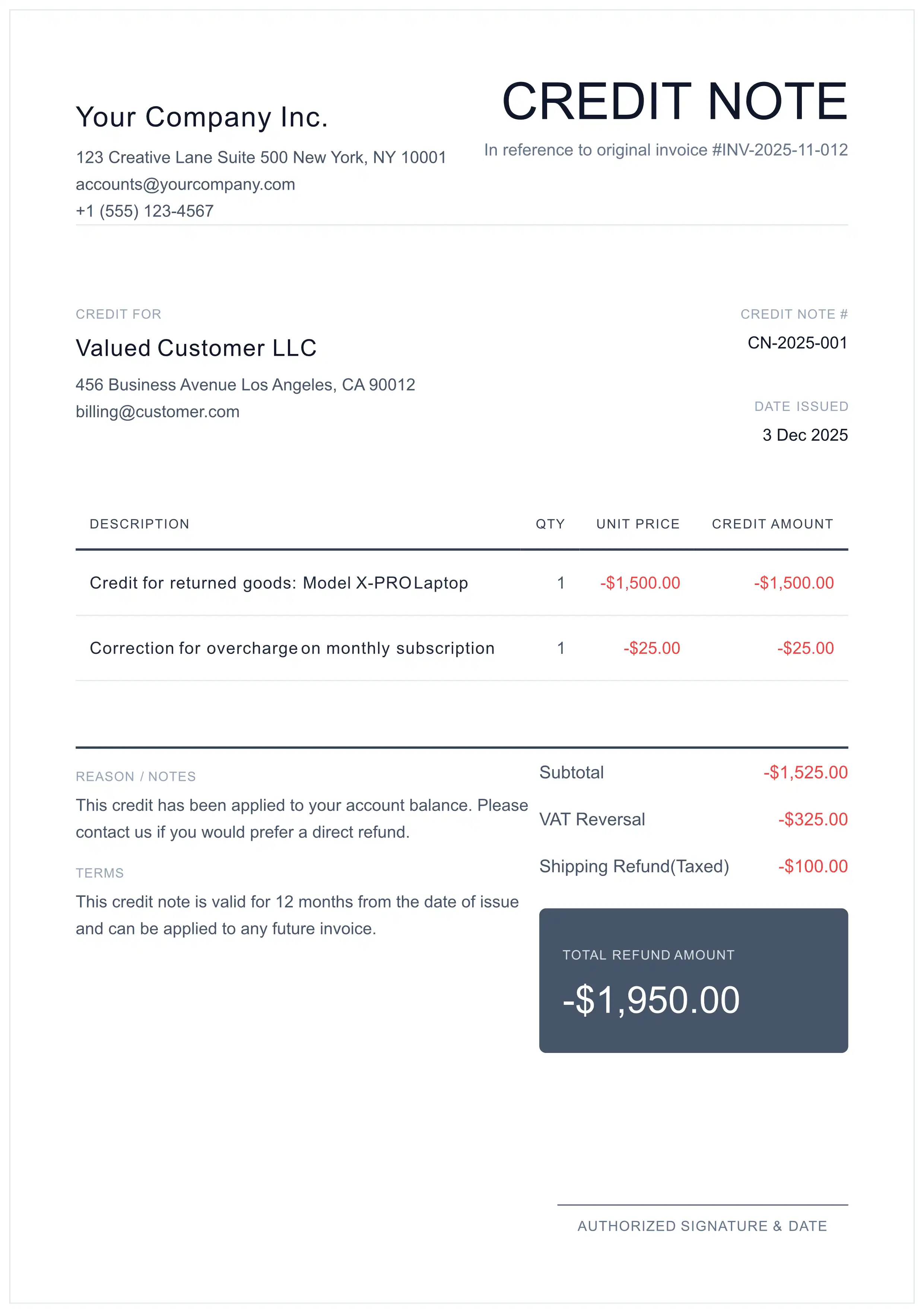

Refund and adjustment documentation.

Create This Invoice →

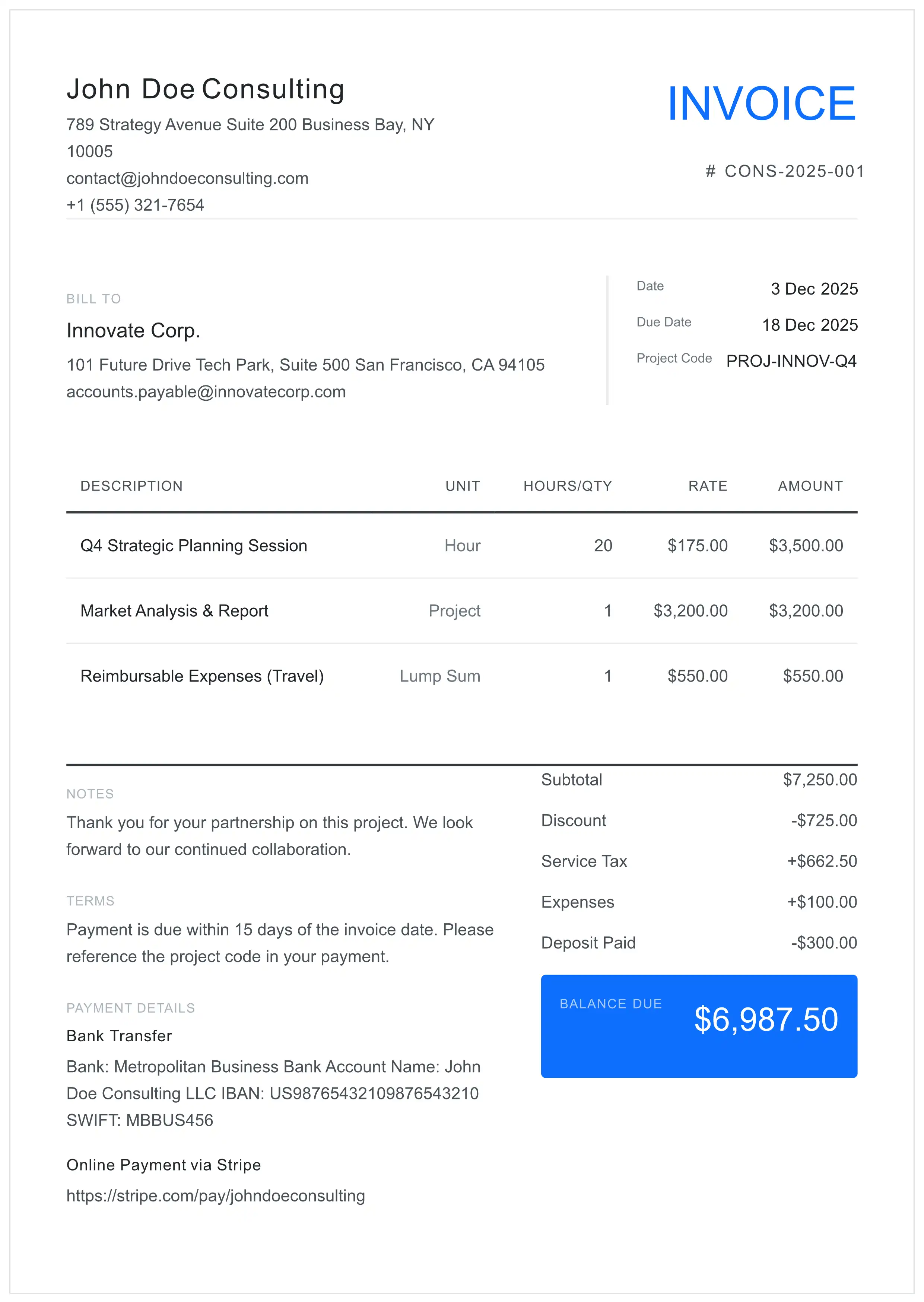

Professional billing for consulting services.

Create This Invoice →

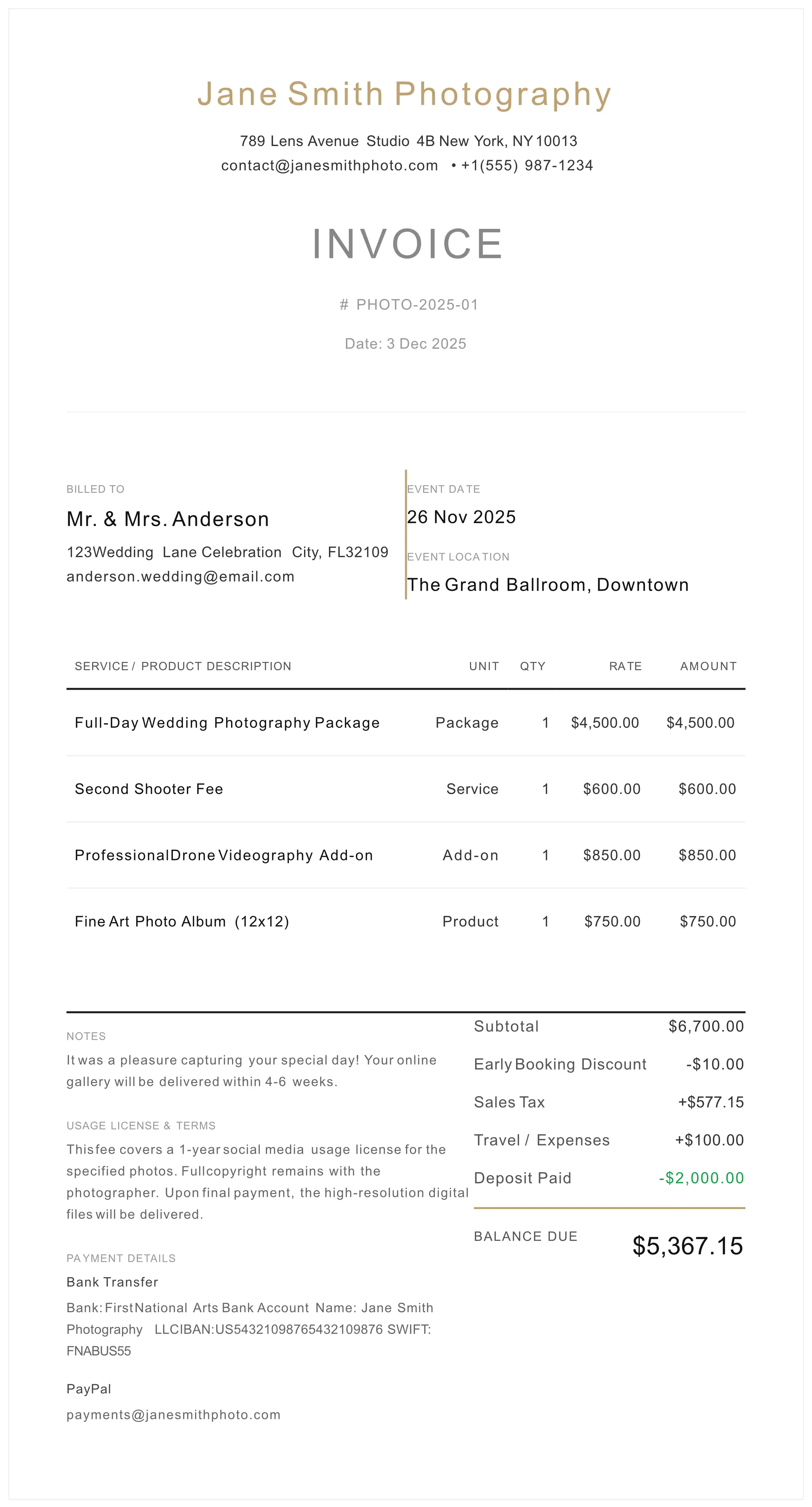

Billing for photo sessions, licensing, and retainers.

Create This Invoice →

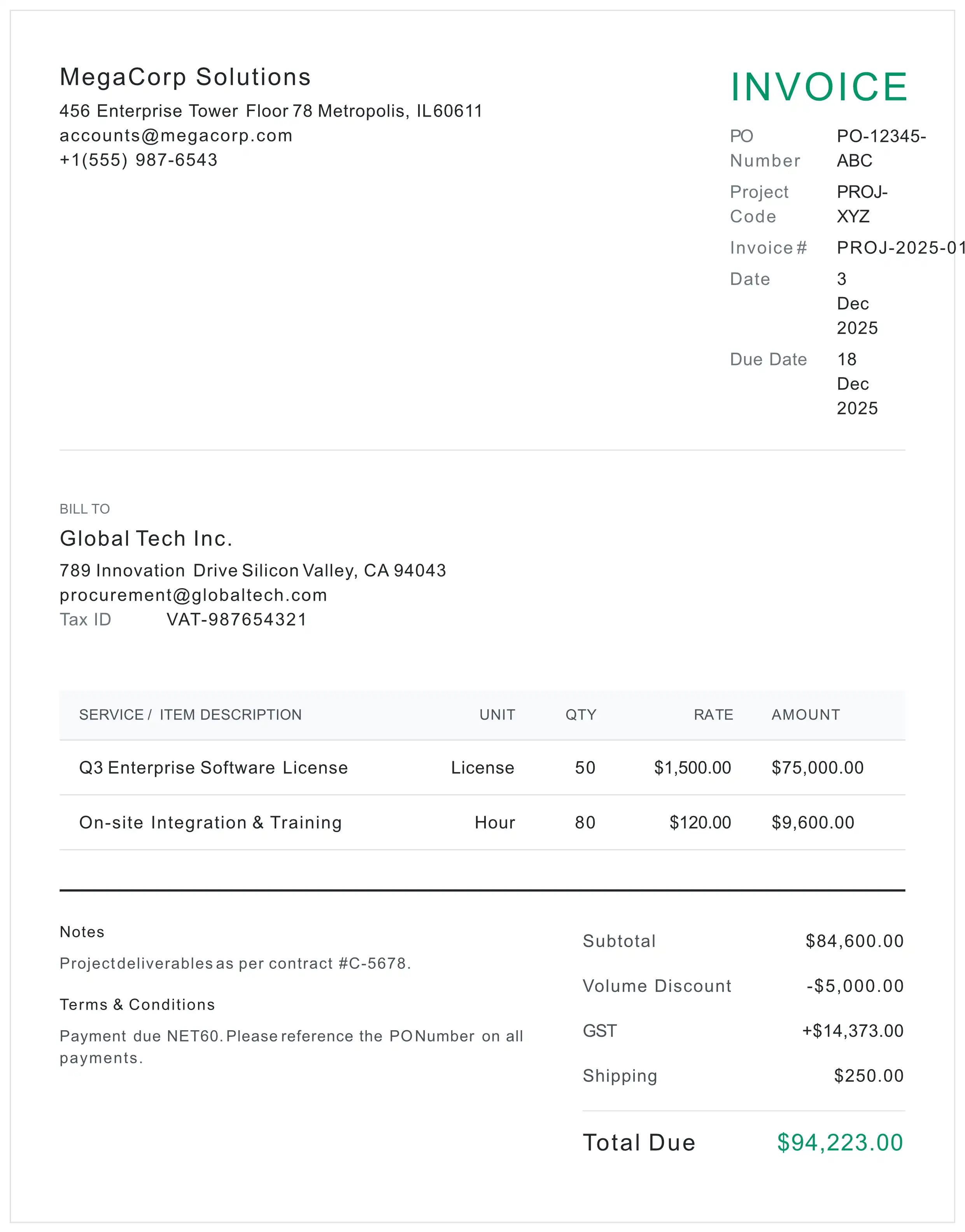

Enterprise billing with project and department codes.

Create This Invoice →

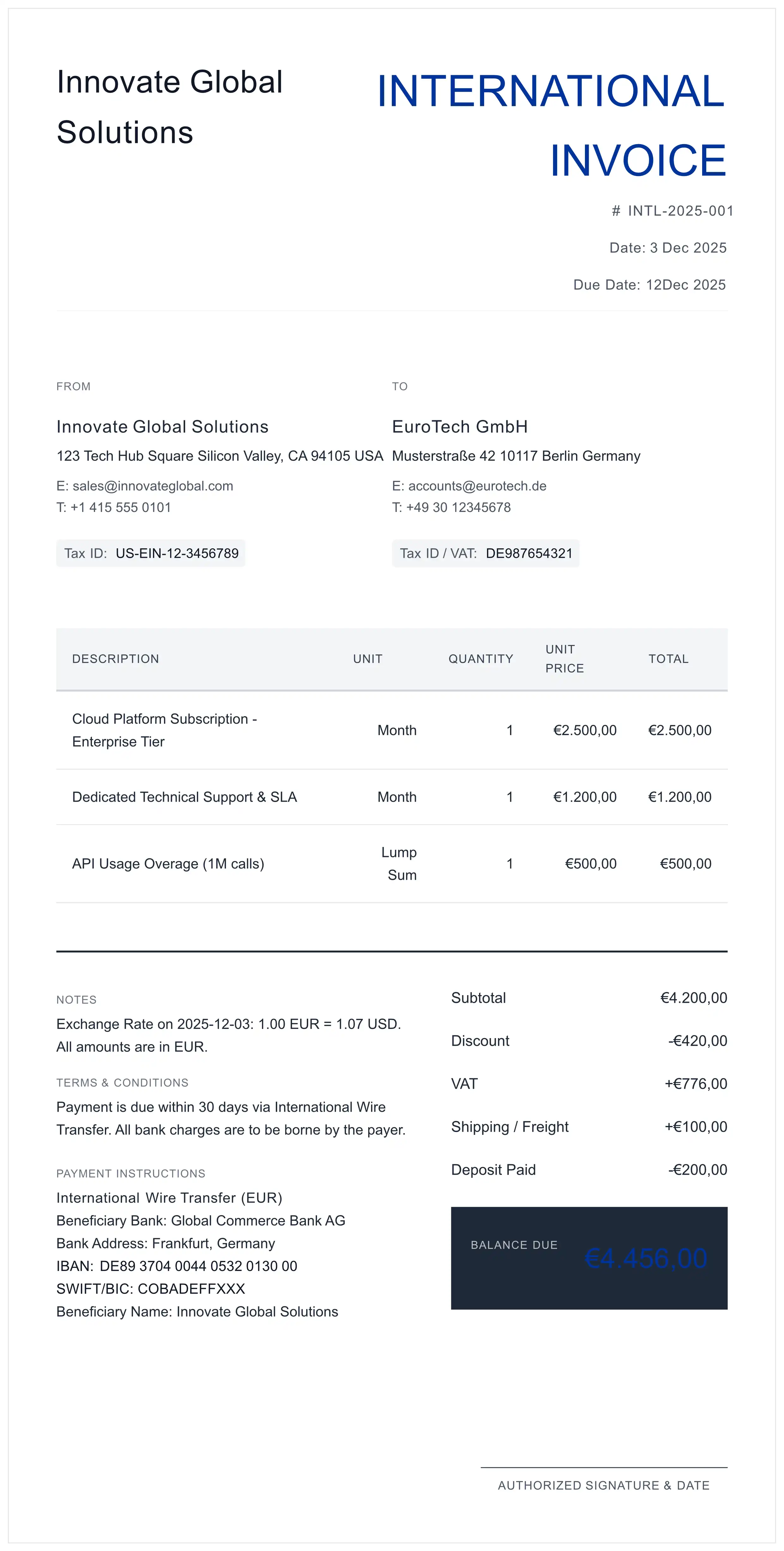

International billing with currency conversion.

Create This Invoice →Fundamental guides for establishing a compliant billing workflow.

A complete technical walkthrough of mandatory data fields, legal requirements, and audit-proof formatting.

Stop chasing liquidity. Learn the legal frameworks behind Net 30, Late Fees, and 'Time is of the Essence' clauses.

Deep-dive technical specifications by category and industry.

Definitions and legal distinctions of primary trade documents.

Cross-border regulations, VAT directives, and banking standards.

Tailored invoicing protocols for specific sectors.

Don't just read about compliance—apply it. Our generator enforces the standards outlined in these guides automatically.

Answers regarding platform compliance and legal standing.

To be legally enforceable, an invoice must contain: a unique sequential ID, the full legal identities of both parties (including Tax IDs where applicable), a clear description of goods/services, the transaction date, payment terms, and the total amount due.

Yes. Our platform and guides are regularly audited against major regulatory frameworks, including the EU VAT Directive, US IRS record-keeping requirements, and Peppol e-invoicing standards.

International invoices should explicitly state the currency code (ISO 4217, e.g., USD, GBP). Best practice dictates including the exchange rate used if converting for local tax reporting purposes. Refer to our 'International Invoicing' guide for specific Incoterms® logic.

Generally, yes. Most tax authorities (IRS, HMRC) accept digital records provided they are immutable (PDF/A), legible, and backed up securely. Our system generates compliant PDF documents suitable for digital archiving.

The main invoice types are: Standard Invoice (basic goods/services billing), Commercial Invoice (customs documentation for exports), Proforma Invoice (pre-shipment quote), VAT Invoice (tax-compliant for EU/UK), Freelance Invoice (hourly/project billing), Contractor Invoice (labor and materials), Credit Note (refunds and adjustments), Consulting Invoice (professional services), Photography Invoice (photo sessions and licensing), Corporate Invoice (enterprise project billing), and Multi-Currency Invoice (international transactions).

For domestic sales, use a Standard Invoice. For international shipping, use a Commercial Invoice. For quotes before sale, use a Proforma Invoice. For EU/UK VAT-registered businesses, use a VAT Invoice. For hourly or project-based work, use a Freelance Invoice. For construction and labor billing, use a Contractor Invoice. For refunds or corrections, use a Credit Note. For professional services, use a Consulting Invoice. For photography work, use a Photography Invoice. For enterprise projects, use a Corporate Invoice. For multi-currency transactions, use a Multi-Currency Invoice.

Yes, all guides, templates, and invoice generators on this platform are completely free to use. No signup required. You can create, download, and use professional invoices at no cost.

Leverage our secure infrastructure to generate audit-proof documentation in seconds.